The Growth of Mobile Payments Best Apps and Security Tips

Introduction

The rapid advancement of technology has ushered in a new age of convenience, notably in managing finances. At the forefront of this transformation are mobile payments, which have become a staple in daily transactions for consumers worldwide. With increased reliance on digital wallets and payment apps, it's essential to understand this evolving landscape and ensure secure transactions.

Advertisement

The Rise of Mobile Payments

Mobile payments have swiftly transformed from a niche market to mainstream adoption. Attributes like convenience, speed, and user-friendly platforms have propelled this growth. By 2023, billions of transactions are conducted through mobile devices annually, affirming this change in consumer behavior. Major drivers include the proliferation of smartphones and enhanced payment technology.

Advertisement

Popular Payment Apps

Several mobile payment apps have emerged as leaders in this sector. PayPal, known for its extensive global reach, allows quick and secure transactions. Apple's digital wallet, Apple Pay, offers seamless contactless payments integrated with their ecosystem. Android Pay, now Google Pay, continues to expand its features, offering rewards and loyalty integrations.

Advertisement

Digital Wallets Redefined

Digital wallets have evolved beyond simple transaction tools. They now provide comprehensive financial management, allowing users to store payment information, loyalty cards, and gift cards. From managing mobile finance to facilitating instant payments, digital wallets encompass a broader spectrum of financial services, redefining traditional banking processes.

Advertisement

The Boom in Contactless Payments

Contactless payments, driven by NFC technology, have seen unprecedented acceptance post-2020. Tapping to pay ensures a hygienic and quick transaction process, appealing to safety-conscious consumers. Retailers across various sectors have adopted this technology, offering reassurance and convenience at the point of sale.

Advertisement

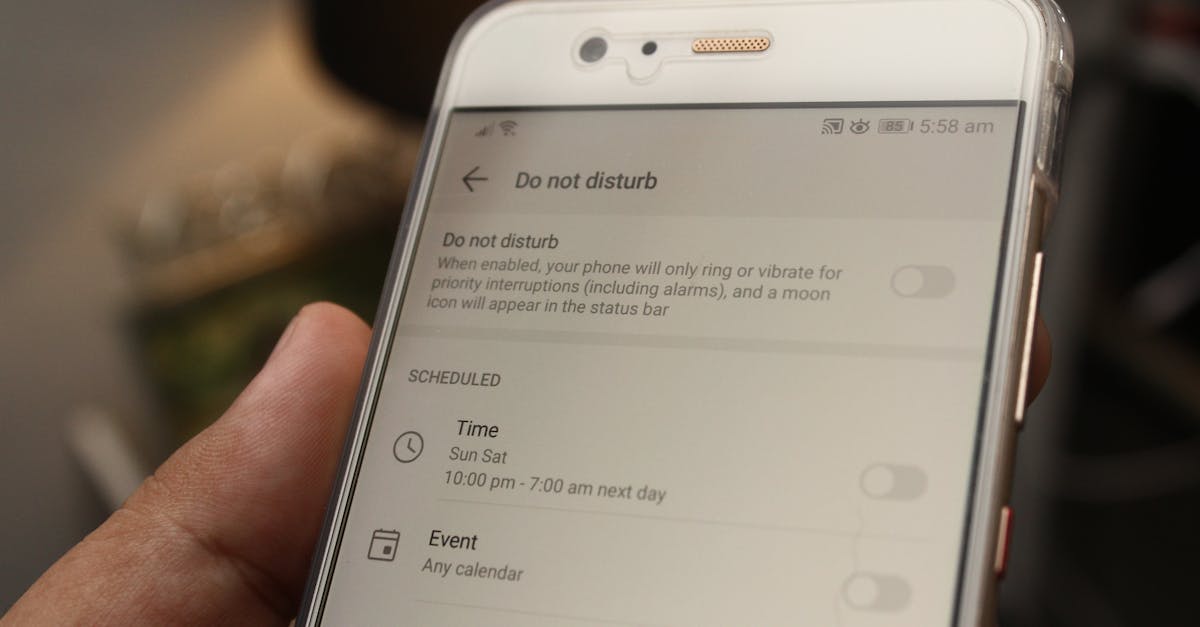

Addressing Mobile Security Concerns

With the growth of mobile banking and payments, mobile security has become paramount. Users must regularly update apps to the latest versions, employ biometric authentication, and activate two-factor authentication for optimal protection. Awareness of phishing scams and prompt reporting of suspicious activities enhance secure transactions.

Advertisement

Android Pay and Its Evolution

Initially launched as Android Pay, this app has undergone significant enhancements to become Google Pay. Real-time transaction notifications, split payments, and peer-to-peer transfers are some of its notable features. Its compatibility with various financial services platforms simplifies mobile finance management for users globally.

Advertisement

Innovations in Payment Technology

The landscape of payment technology is continually evolving. Biometric payments, such as facial recognition and fingerprint authentication, are gaining traction. Blockchain and AI-driven fraud detection are also being integrated to ensure security. These innovations promise to make mobile payments safer and more efficient.

Advertisement

The Role of Secure Transactions

Ensuring secure transactions remains the backbone of mobile payment apps. Encryption technology, tokenization, and SSL certifications are critical in protecting data integrity. As consumers continue to embrace mobile finance, developers and financial institutions invest continuously in strengthening these security measures.

Advertisement

Summary or Conclusion

In conclusion, mobile payments and related technology have reshaped how transactions are conducted. From the convenience of payment apps to robust mobile security practices, the landscape is rich with innovations and solutions. Embracing these advancements while prioritizing secure transactions ensures that both consumers and businesses benefit from this digital evolution.

Advertisement