How To Manage Personal Debt Effectively in 2024

Introduction

Managing personal debt is a crucial skill to master, especially in 2024, as economic landscapes continue to evolve. With proper debt management, financial stability becomes more attainable, reducing stress related to financial burdens. Embark on this journey to learn practical strategies for managing your personal debt effectively.

Advertisement

Understanding Your Debt

The first step in managing personal debt is understanding its nature and extent. Begin by listing all your debts, including credit cards, student loans, and personal loans. This will provide a comprehensive view of your financial obligations, helping you prioritize and devise an effective repayment plan.

Advertisement

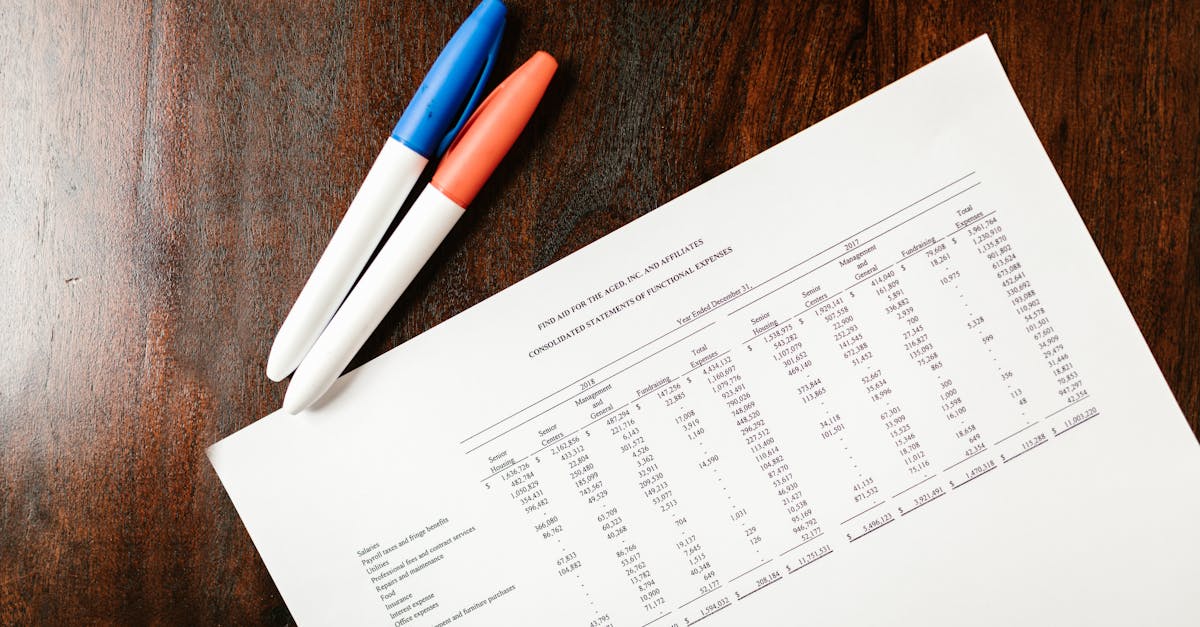

Budgeting for Debt Management

Creating a budget is essential for efficient debt management. Assess your monthly income and expenses to identify how much you can reasonably allocate to debt repayment. Prioritize essential expenses while earmarking a portion of discretionary income towards debt reduction, ensuring consistent progress.

Advertisement

Prioritizing Debts

Not all debts are created equal, making prioritization a pivotal debt-management strategy. Focus on high-interest debts first, such as credit cards, to minimize the cumulative interest you pay over time. This approach, known as the avalanche method, can significantly reduce the total repayment period.

Advertisement

Exploring Debt Consolidation Options

For those overwhelmed by multiple debts, consolidation offers a reprieve. Consider combining various debts into a single, more manageable payment. Consult financial experts or explore online tools for the best consolidation loans that offer lower interest rates and favorable terms.

Advertisement

Mindful Spending Habits

Curb unnecessary spending by adopting mindful purchasing habits. Before making a purchase, especially with credit, evaluate its necessity and any potential impact on your debt repayment plan. Practicing mindfulness in spending supports your broader financial goals, allowing for a more disciplined approach to debt reduction.

Advertisement

Building an Emergency Fund

While managing debt, it's equally important to create an emergency fund. This acts as a financial buffer against unexpected expenses, preventing new debt accumulation. Aim to have three to six months' worth of living expenses saved, ensuring you're prepared for unforeseen financial challenges.

Advertisement

Seeking Professional Advice

Sometimes, managing personal debt requires professional intervention. Financial advisors or credit counseling services can provide personalized strategies tailored to your situation. They can offer guidance on making informed financial decisions and navigating complex financial landscapes, leading to more successful debt management.

Advertisement

Benefits of Regular Financial Monitoring

Consistent financial monitoring is essential to staying on track. Regularly review your budget, expenses, and repayment progress to ensure your strategies remain effective. Adjust as needed to accommodate life changes or shifts in your financial landscape, maintaining momentum towards debt reduction goals.

Advertisement

Conclusion

Effectively managing personal debt in 2024 involves understanding your debt, creating a budget, and prioritizing repayments. Exploring consolidation options and adopting mindful spending habits can enhance your financial stability. With perseverance and informed decision-making, achieving financial freedom is within reach.

Advertisement